trust capital gains tax rate uk

Avoiding Capital Gains Tax. The rates are much less onerous.

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

It supplements the basic guidance in.

. Under the Tax Cuts Jobs Act which took effect in 2018 eligibility for the. The general capital gains tax rate in Colombia is 10 with the exception of lottery or gambling winnings which are taxed at 20. Gains from selling other assets are charged at 10 for.

When you own an asset for more than a year and sell it for a profit the IRS classifies that income as a long-term capital gain. The capital gains tax would then be due via Self Assessment. If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax.

For people in the 10 or 12 income tax bracket the long-term capital gains rate is 0. There is more information on GOVUK about the records the personal representative will need for the trust and estate tax return and about how to pay any CGT liability elsewhere on GOVUK. The remaining 66650.

After-tax money funds these long-term investment. Your capital gains are offset by your capital losses. The 1012 Tax Bracket.

If your income falls in the 40400441450 range your capital gains tax rate as a single person is 15 in 2021. Sell off losing investments. Other types of accounts like a Roth IRA or a 529 college savings plan are great options for building wealth without incurring capital gains.

The IRS allows 250000 of tax-free profit on a primary residenceWhat this means in a simplified sense is if you bought your primary residence for 300000 in 2010 lived in it for 8 years and then sold it in 2018 for 550000 you wouldnt have to pay any capital gains tax. For example suppose you own some stock that you purchased for 50000. It was introduced in 2015 with 12 and reduced to 10 in 2021.

If you have some investments that have decreased in value since you bought them selling them would reduce your total capital gains. The maximum amount you can get is 50000. Main residence exemption allows homeowners to avoid paying capital gains tax if their property is their principal place of residence PPOR.

Instead of taxing it at your regular income tax rate they tax it at the lower long-term capital gains tax rate 15 for most Americans. The rates are much less. You do not have to sell an asset before you invest.

Capital gains exceeding the threshold limit of INR 100000 on transfer of a long-term capital asset being listed equity share in a company or a unit of an equity-oriented fund or a unit of a. The US capital gains tax rate is as high as 20. Short-term capital gain tax applicable on this type of asset is calculated as per the slab rate applicable to the non-resident.

The most significant exemption is the family home. Capital Gains Tax Exemptions or Discounts. For example if your completion date for a property disposal is 28 March 2022 then provided you file your Self Assessment tax return for 202122 including the disposal by 27 May 2022 then you will not usually need to file a 60-day return or pay the capital gains tax within 60 days.

The income range rises slightly to the 41675459750 range for 2022. Many people qualify for a 0 tax rate. Capital Gains Tax CGT is imposed at the rate of 20 on.

The tax-free allowance is 11700 for individuals and 5850 for trusts. The small business. You can get Capital Gains Tax relief on 50 of the investment up to 100000.

Long-term capital gains tax rates typically apply if you owned the asset for more than a year. Additionally the government requires you only to pay the capital gains tax if the gains you make throughout the year on a sale exceed what is known as the Annual Exempt Amount AEA. From 201718 corporate entities eligible for the lower tax rate have been known as base rate entities.

Here are the long-term capital gains tax brackets for 2020 and 2021. Fortunately when you inherit real estate the propertys tax basis is stepped up which means the value is re-adjusted to its current market value and often reduces or entirely eliminates the capital gains tax owed by the beneficiaryFor example Sallys parents purchased a house years ago for 100000 and bequeathed the property to Sally. Short-term capital gains tax on other assets The securities other than debt mutual funds and shares of an Indian company that are sold in less than 24 months qualify as short-term capital asset.

Therefore a capital gain of 260000 480000 selling price less 220000 cost will result in US capital gains taxes of 52000. Youll pay taxes on your ordinary income first and then pay a 0 capital gains rate on the first 33350 in gains because that portion of your total income is below 83350. You can claim a foreign tax credit on your US return for the Canadian taxes paid and so your US capital gains tax of 52000 should be reduced to 0 after the.

The first one is main residence exemption. Capital Gains Tax on Rental Property VS. There are several ways in which you can avoid capital gains tax.

Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits on the sale of a home. Capital gains tax rates for 2022-23 and 2021-22. However if you held the property for 366 days or more its considered a long-term asset and is eligible for a lower capital gains tax rate 0 percent 15 percent or 20 percent depending.

This manual is to help people compute chargeable gains and allowable losses for both capital gains tax and corporation tax purposes or check computations. The capital gains tax in Croatia equals 10. The rate of tax on chargeable capital gains on disposals by the estate of chargeable assets other than residential property is 20.

Reference 5 Because you still have incidents of ownership however and provided you live there you remain eligible for the federal 250000 capital gains exclusion 500000 if youre. Capital Gains Tax CGT in the context of the Australian taxation system applies to the capital gain made on disposal of any asset except for specific exemptions.

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Pin By Tax Doctors Group On Https Taxdoctorsgroup Blogspot Com Capital Gains Tax Income Tax Income Tax Return

Tax Advantages For Donor Advised Funds Nptrust

Maximize Next Generation Assets With Intentionally Defective Grantor Trusts Bny Mellon Wealth Management

2021 Trust Tax Rates And Exemptions

Will Meet Fy20 Direct Tax Target Of Rs 11 7 Lakh Cr Mody Tax Debt Filing Taxes Capital Gains Tax

Income From A Trust Or From The Estate Of A Deceased Person Low Incomes Tax Reform Group

The Tax Implications Of Trusts Crowe Uk

Dns Accountants Is One The Excellent Accounting And Tax Consultancy Services In Borehamwood Uk Having Accounting Accounting Services Professional Accounting

Capital Gains Tax Cgt Holdover Relief Trusts Mercer Hole

Difference Between Income Tax And Capital Gains Tax Difference Between

The Tax Implications Of Trusts Crowe Uk

Reit Investments Tax Implications In India Real Estate Investment Trust Investing Reit

Too Old Or At A Golden Age Pwc Rates Countries Success Harnessing Power Of Older Workers Http Pwc To 1ite8kh Older Top Country Golden Age

Generation Skipping Trust Gst What It Is And How It Works

What Is Capital Gains Tax Www Qredible Co Uk Bina Haber

Understanding Capital Gains Tax In Planning Your Estate Trust Will

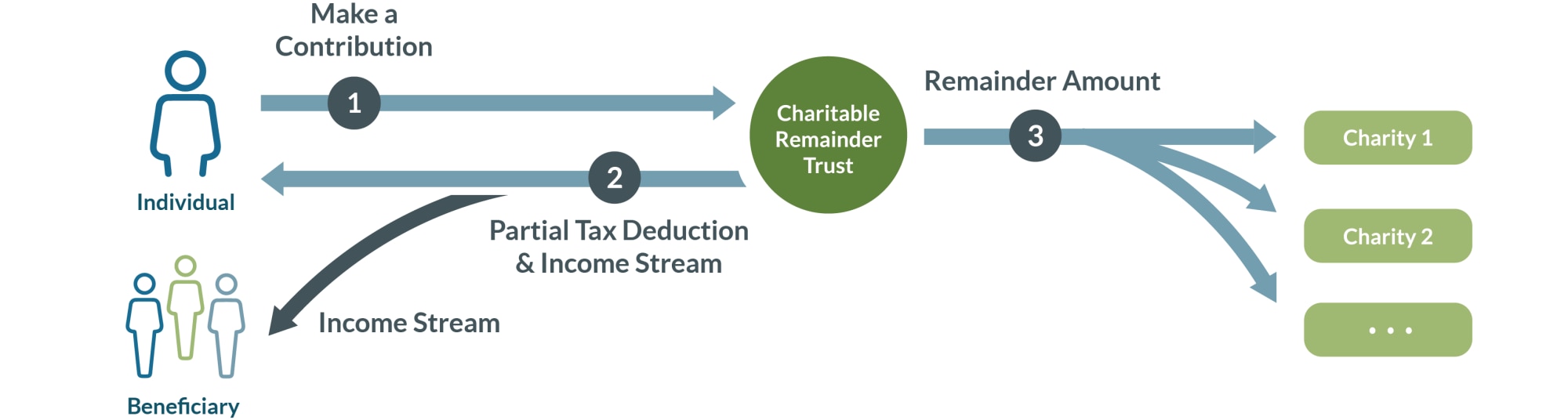

Charitable Remainder Trusts Fidelity Charitable

Installment Sale To An Idgt To Reduce Estate Taxes Grantor Trust Estate Tax Business